ai that listens and predicts

everywhere customers talk

Turn unstructured data like calls, emails, and chat transcripts into proactive intelligence.

insight and action at the speed of data

Detect traits, track trends, and trigger workflows with streaming AI that continuously

queries customer data for what matters to your business

Unlock Dormant Data TO FIND

ENTERPRISE Insights

Frame AI translates unstructured data – the calls, emails, surveys and documents that comprise 80% of what enterprises capture – into insights that inform operations and strategic decisions across teams. This untapped asset contains critical insights about what consumers want, and what they may do with respect to a brand. Unlocking it fosters alignment, efficiency, growth, and ultimately competitive advantage.

LEARN MORE

HARNESS AI TAILORED TO

YOUR BUSINESS

Frame AI isn’t an “one-size-fits-all” tool – it is a central platform where businesses can deploy tuned NLP models, calibrated predictive models and engineered prompts. By doing so, Frame AI allows enterprises to invest once in providing AI with critical context about their business and deploy it across many applications, averting pitfalls and inaccuracies common to “generic” APIs and SaaS solutions.

LEARN MORE

Amplify Existing Processes,

Tools, and Teams

Frame AI’s STAG architecture proactively injects Generative AI assistance directly into your existing platforms and practices, making the most of your existing investments. By providing a solution that is integrated with existing security, data governance / compliance, and operational frameworks, Frame AI lowers time-to-value and eliminates the disruption many businesses are feeling in adopting AI technologies.

LEARN MOREindustry

leaders

giving their

data a voice

Act on what

your business

needs in real

Time

Proactive insights contextualize customer risks and opportunities, enabling immediate, informed decision-making to drive efficiency and growth while keeping data secure.

Unify Data Streams

Activate your data where it lives. Using NLP, machine learning, and generative AI, identify Moments that Matter (MtM) in customer interactions.

Enrich with meaning

Leverage AI to gain insights, predict outcomes, enrich profiles, and automate actions. Boost efficiency while minimizing disruption.

Enhance Existing Systems

Integrate AI into your existing systems to avoid rebuilding models, accelerate time to ROI, and maximize efficiency.

monitor and track impact

Monitor and track key moments in real-time, capturing opportunities and risks to optimize actions for better outcomes.

Maintain data control

Ensure data accuracy, security, and compliance at all times with AI that centralizes your data investment.

leverage Frame Ai expertise

Collaborate with AI experts to optimize solutions, improve performance, and achieve your business goals efficiently

PROACTIVE TOOLS

FOR EVERY TEAM

Equip every team with proactive tools that leverage streaming customer data across all systems, not just what’s locked in vendor ecosystems. Frame AI triggers workflows wherever teams are already working, injecting proactive, Generative AI into your existing investments.

Safety & Compliance

- Risk Monitoring

- Automated Documentation

- AQA

- Scheduled Reports

Marketing

- Profile Traits

- Campaign Triggers

- Account Alerts

- Product Feedback

CUSTOMER EXPERIENCE

- Cost Driver Detection

- Predicted CSAT

- AQA

- Escalation Alers

THE LATEST

Why BYOC Excels for Regulated Industries

Bring Your Own Cloud provides the flexibility of cloud-based management with the rigorous control that regulated industries demand.

Big News: Frame AI Joins Hubspot

By George Davis, CEO & Founder

Can AI Solve the Bad Leads Problem?

Traditional lead-scoring methods rely on surface-level data, creating a disconnect between sales and marketing.

When sales receives an undifferentiated list of leads, it often feels “low quality,” even though there may be valuable opportunities hidden within. The problem isn’t the leads themselves—it’s the inability to discern which ones truly matter.

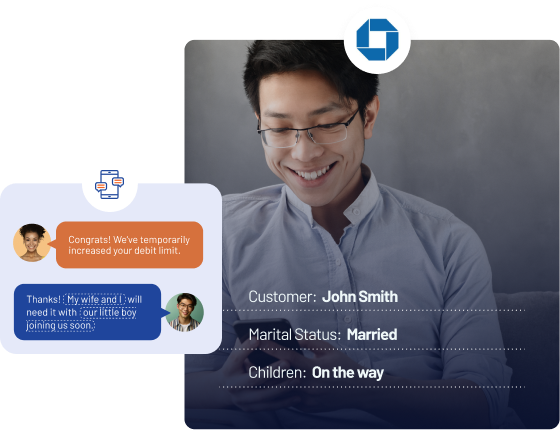

Forbes: Can Small and Mid-Size Banks Survive AI?

In today’s consumer banking landscape, small- and mid-sized banks, once valued for local relationships, are facing new challenges as customers prioritize digital convenience. With major banks investing billions in AI to enhance personalization and efficiency, smaller institutions are feeling the pressure to keep up. AI presents an opportunity for these banks to restore and amplify their hallmark of personalized service. By outsourcing AI capabilities through cloud banking providers, these banks can improve customer experience, automate routine inquiries, and focus resources on meaningful customer connections. This strategic blend of technology and human touch can help smaller banks regain a competitive edge in a crowded market.

Learn how Frame Ai’s enterprise api

empowers platforms across the world

SIGN UP FOR MONTHLY INSIGHTS ON

HOW TO LEVERAGE AI FOR UNSTRUCTURED DATA

Case studies, interviews, and tips and tricks learned from harnessing AI for more strategic

implementation of your data.